SUMMARY

Brand (confidential) - Aimed to simplify and streamline cross-border transfers and ordering travel cash. Addressing the challenges and inefficiencies associated with traditional banking.

YEAR

ROLE

CONTRIBUTION

PLATFORM

2021

LEAD UX/PRODUCT DESIGNER

UX - UI - DESIGN SYSTEMS

WEB - IOS & ANDROID

Brand (confidential) - Aimed to simplify and streamline cross-border transfers and ordering travel cash. Addressing the challenges and inefficiencies associated with traditional banking.

YEAR

2021

ROLE

LEAD UX/PRODUCT DESIGNER

CONTRIBUTION

UX - UI - DESIGN SYSTEMS

PLATFORM

WEB - IOS & ANDROID

PROBLEM & GOAL

GOAL

The goal was to make travel and the financial association with it more convenient for users with swift international payments with low fees. Aswell as allow users to spend abroad with the best exchange rates with security as a top priority

PROBLEM

With traditional banking there is frustrations with the speed of transactions, the fees involved, regulatory hurdles, poor support/customer service and needing a intuitive user friendly interface

Research

DISCOVERY

METHODS

Customer Interviews Persona Market Analysis

Quantitative Surveys User Journeys Competitive Analysis

PROCESS

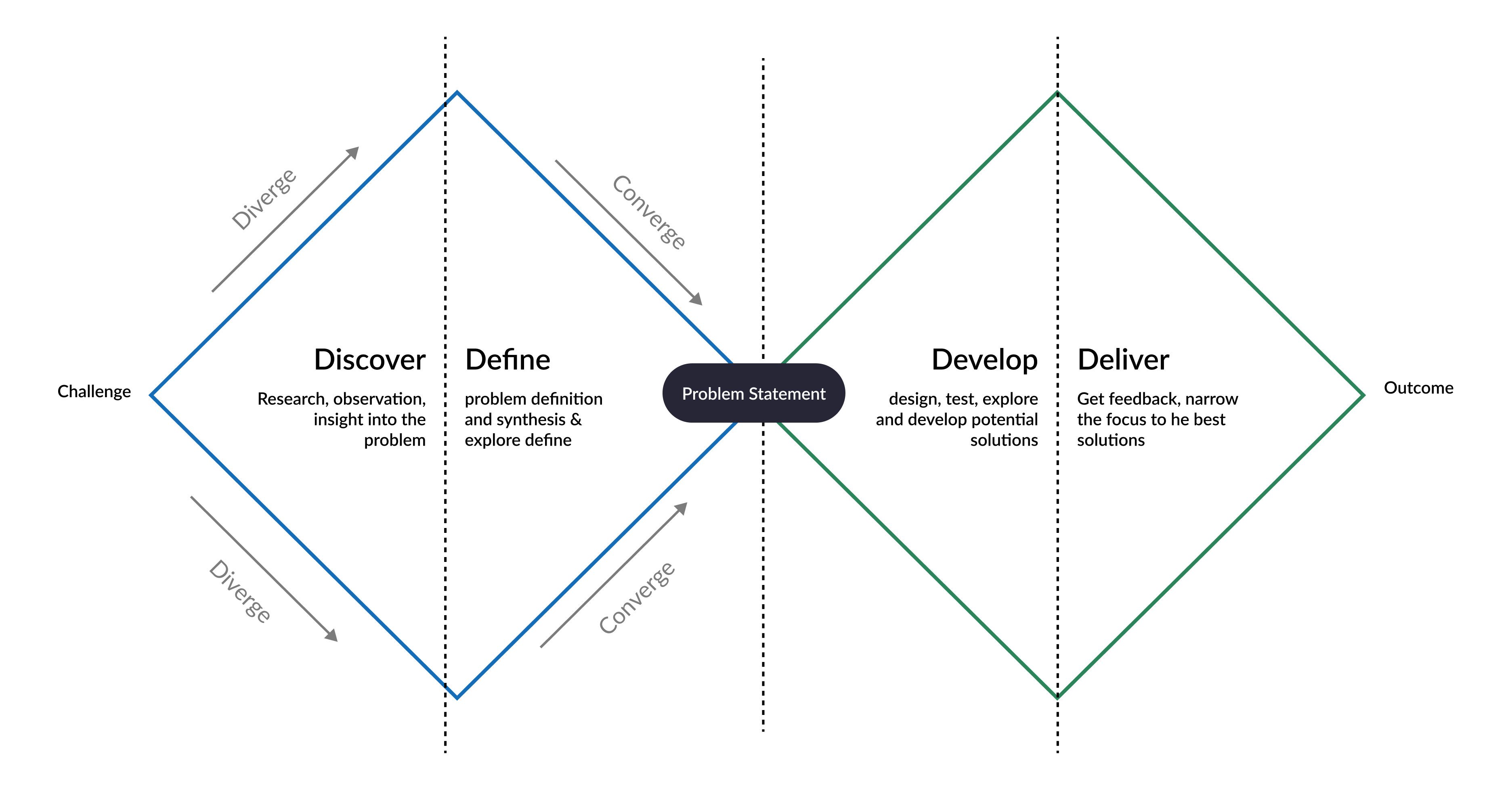

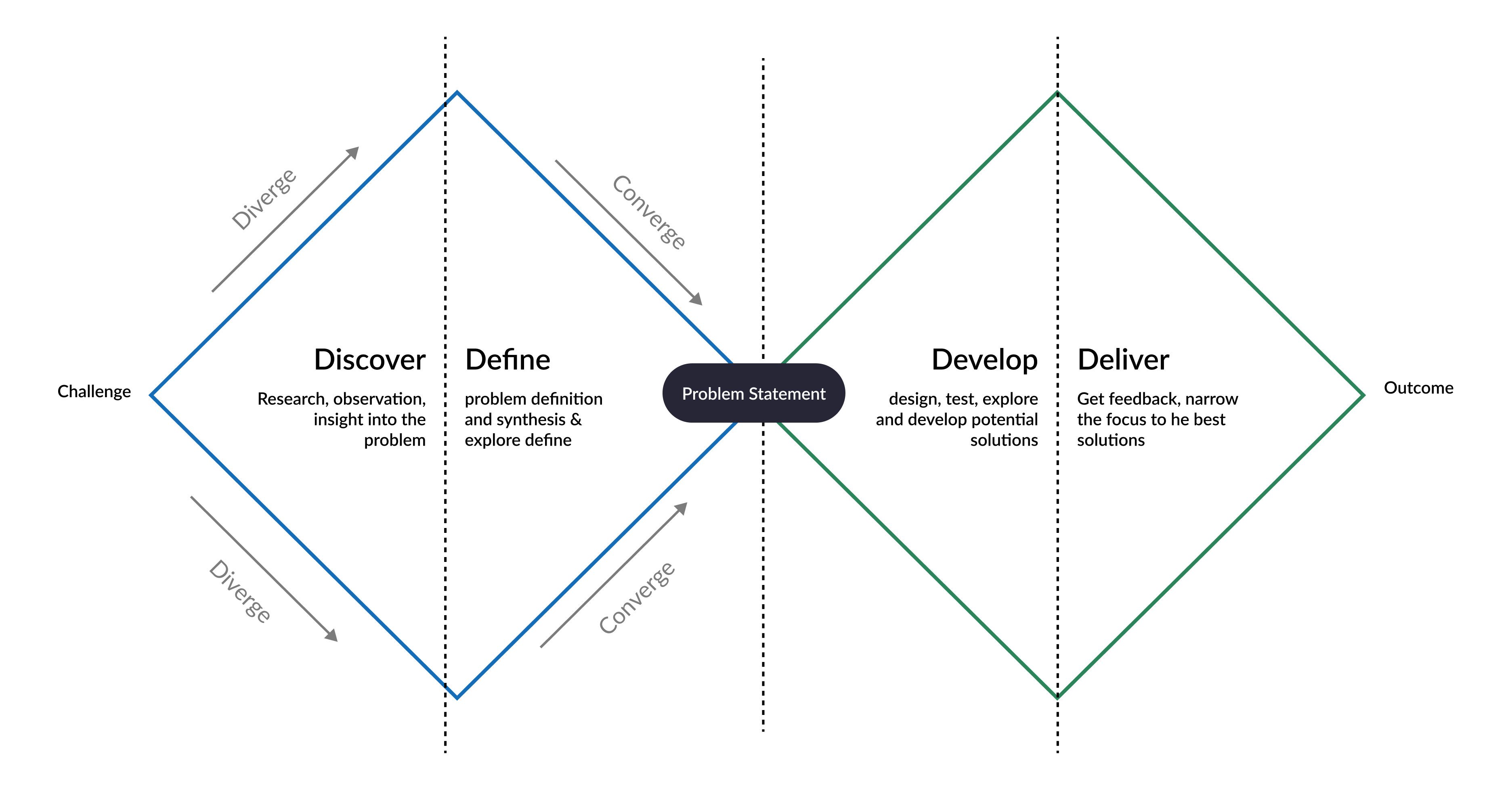

Following the Double Diamond design framework that was popularized by the British Design Council. It represents a structured approach to solving design problems and creating user-centered solutions.

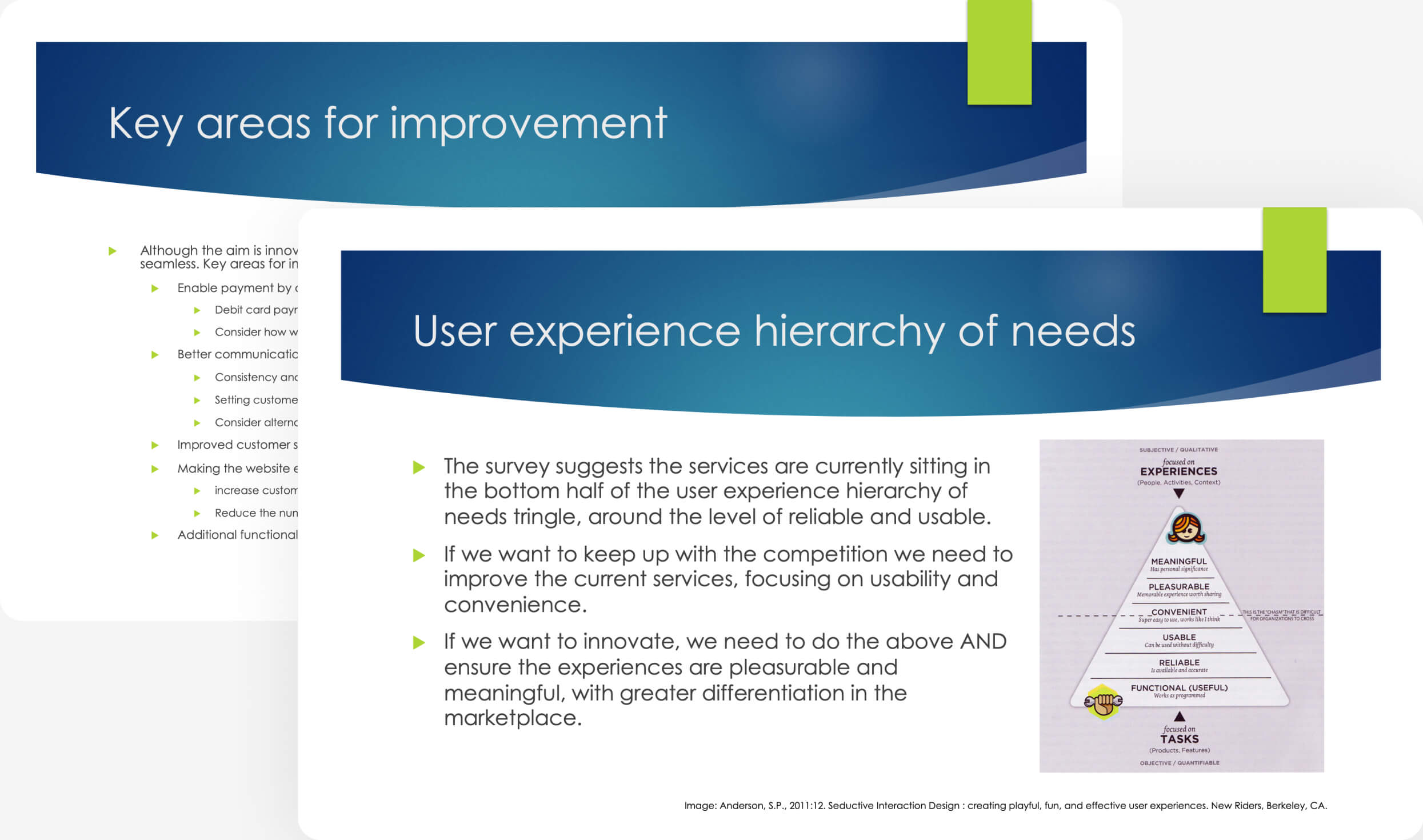

UNDERSTANDING THE RESEARCH

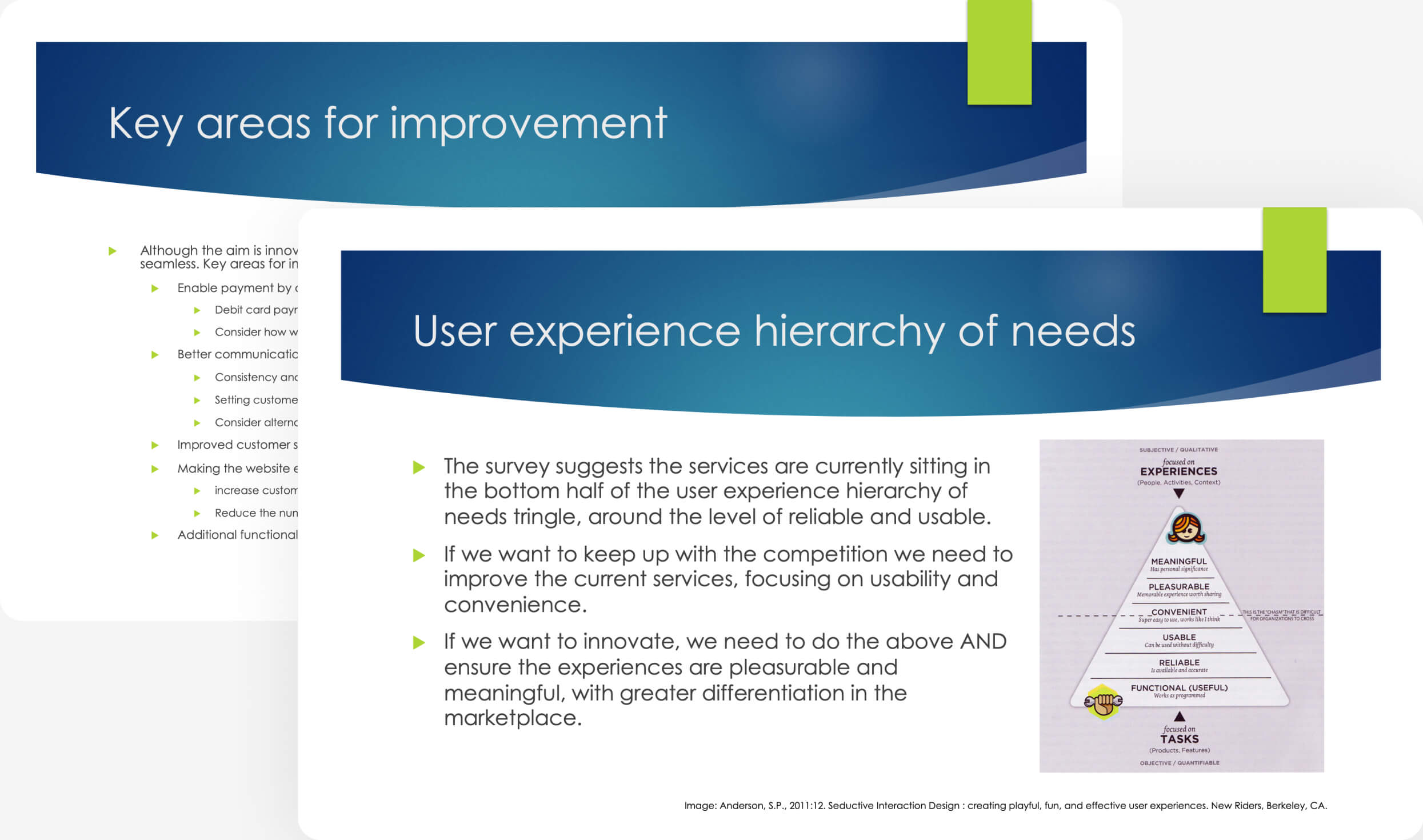

Presenting to stake holders decks with research data to accomodate and communicate the users needs and goals. Research synthesized data also takes into account competitor bench marking as well as online reports.

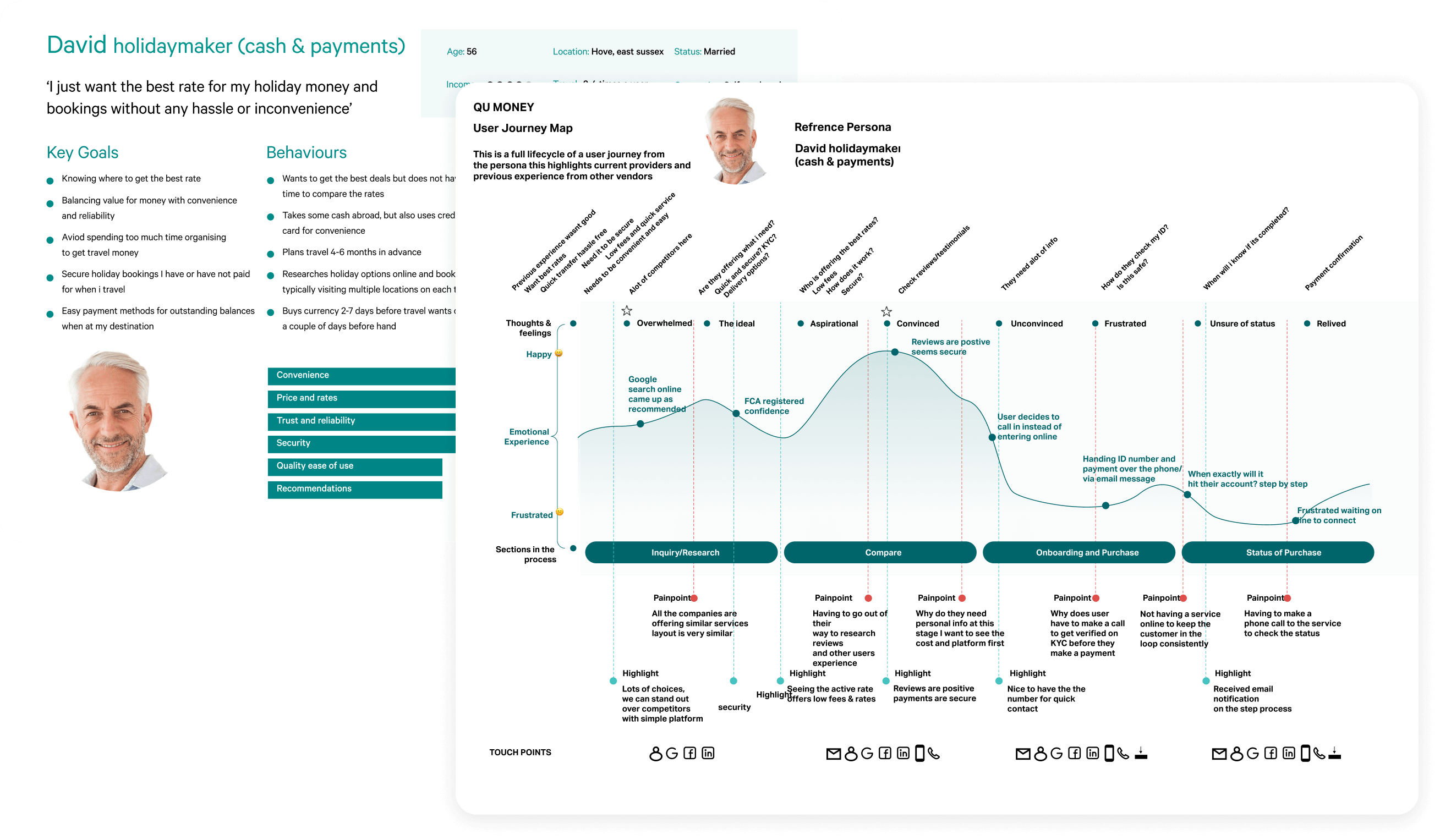

FORMING PERSONA’S AND MAPPING THE USER JOURNEY

Planned to better understand the target audience and create more user-centered solutions. The data taken into account was both Quantitative Data and Qualitative Data. This was important to Identify patterns and trends within the space

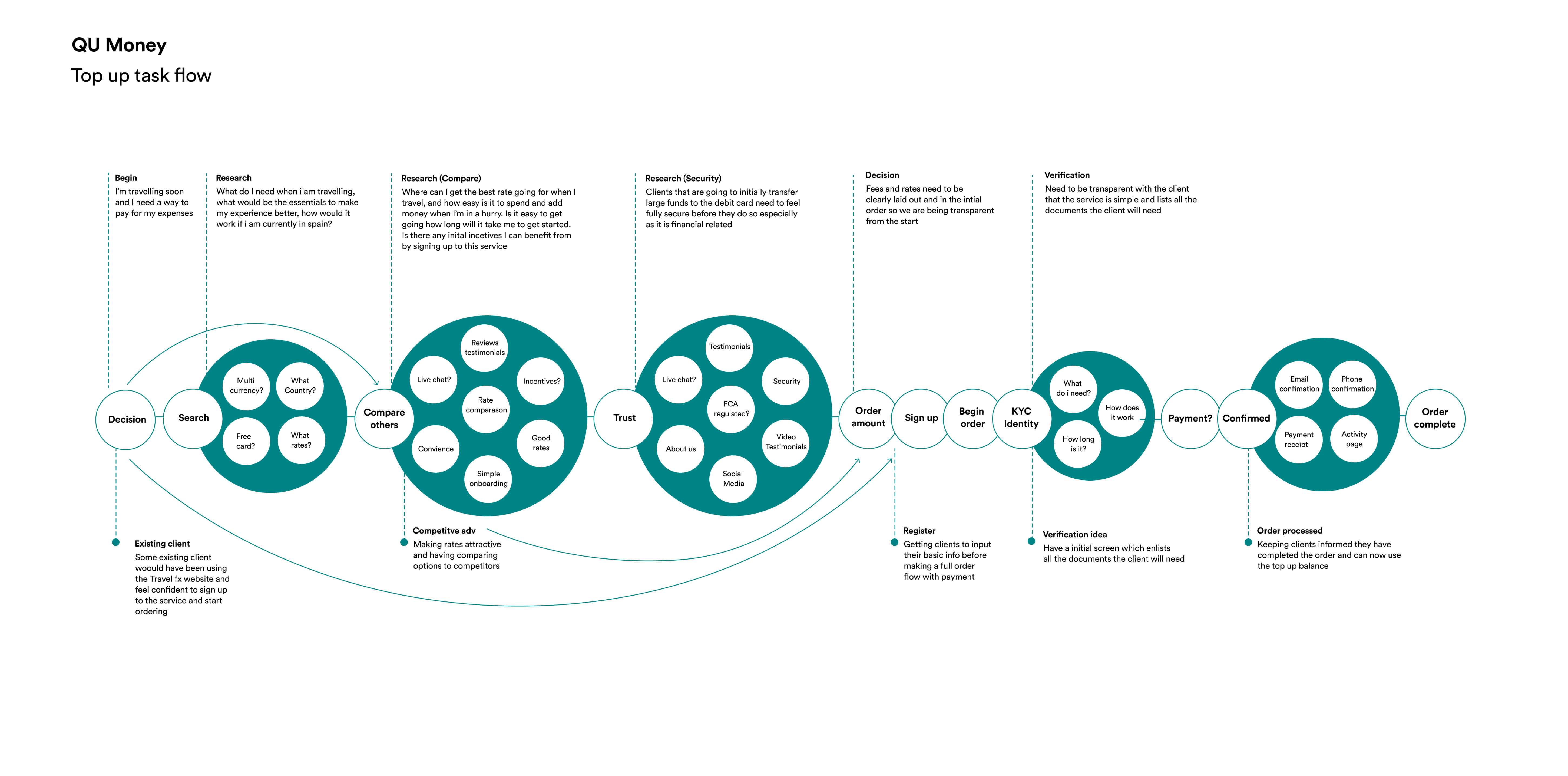

FURTHER EXPANSION OF USER JOURNEY - TASK FLOWS

I created this document to further support the user journey and visualise the key actions at a highlevel

Synthesis and Key Focus

Translated raw data into actionable insights, facilitating the creation of user-centered solutions that effectively address user goals and challenges.

Mapping It Out

Visual UI Brand - Explore & Play

CREATING UI FOUNDATIONS STYLE GUIDE

Establishing a comprehensive set of design principles, components, and guidelines to ensure consistency and coherence in within the UI. Built using the Atomic system as reference.

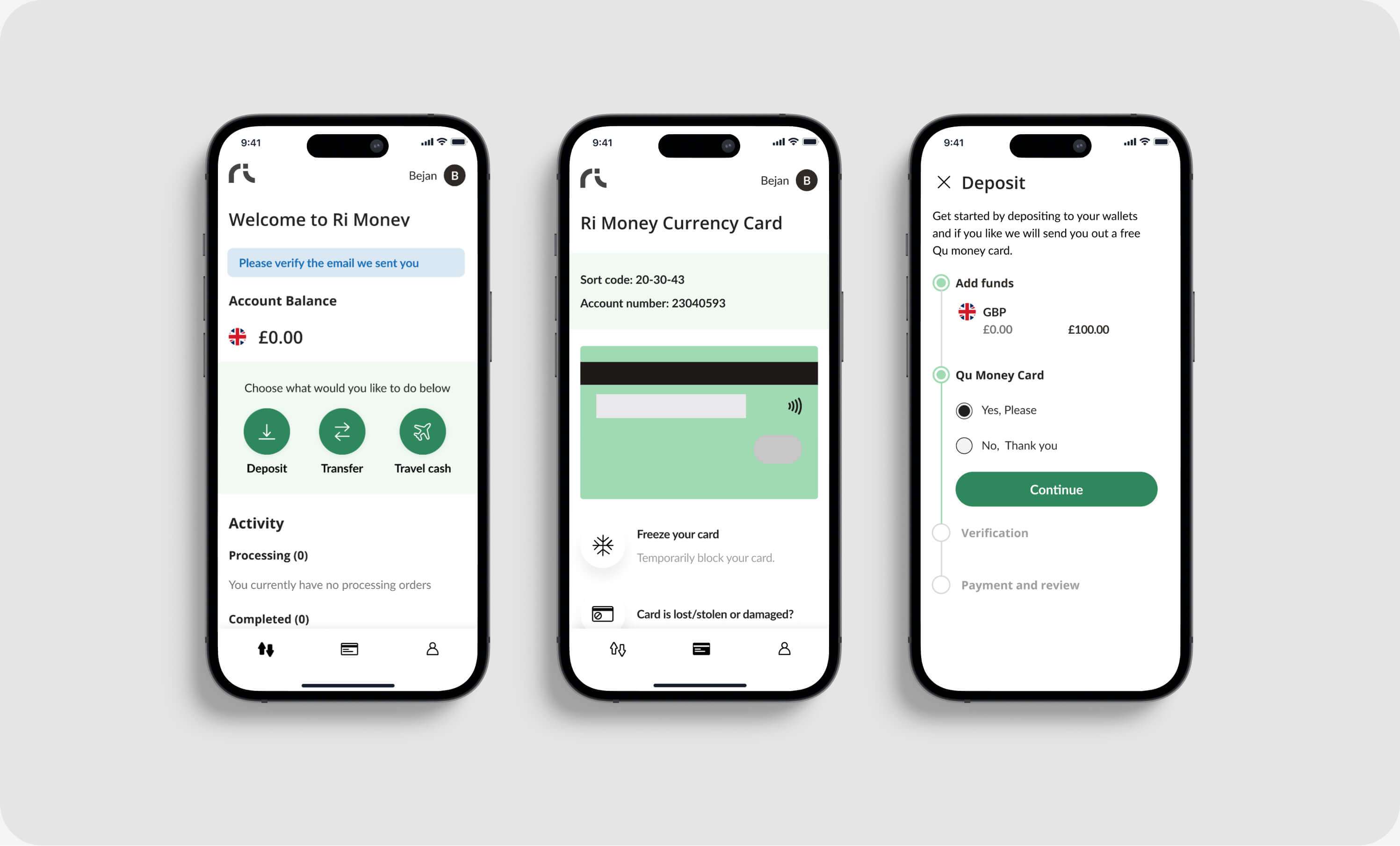

WORKING ON THE SCREEN FLOWS

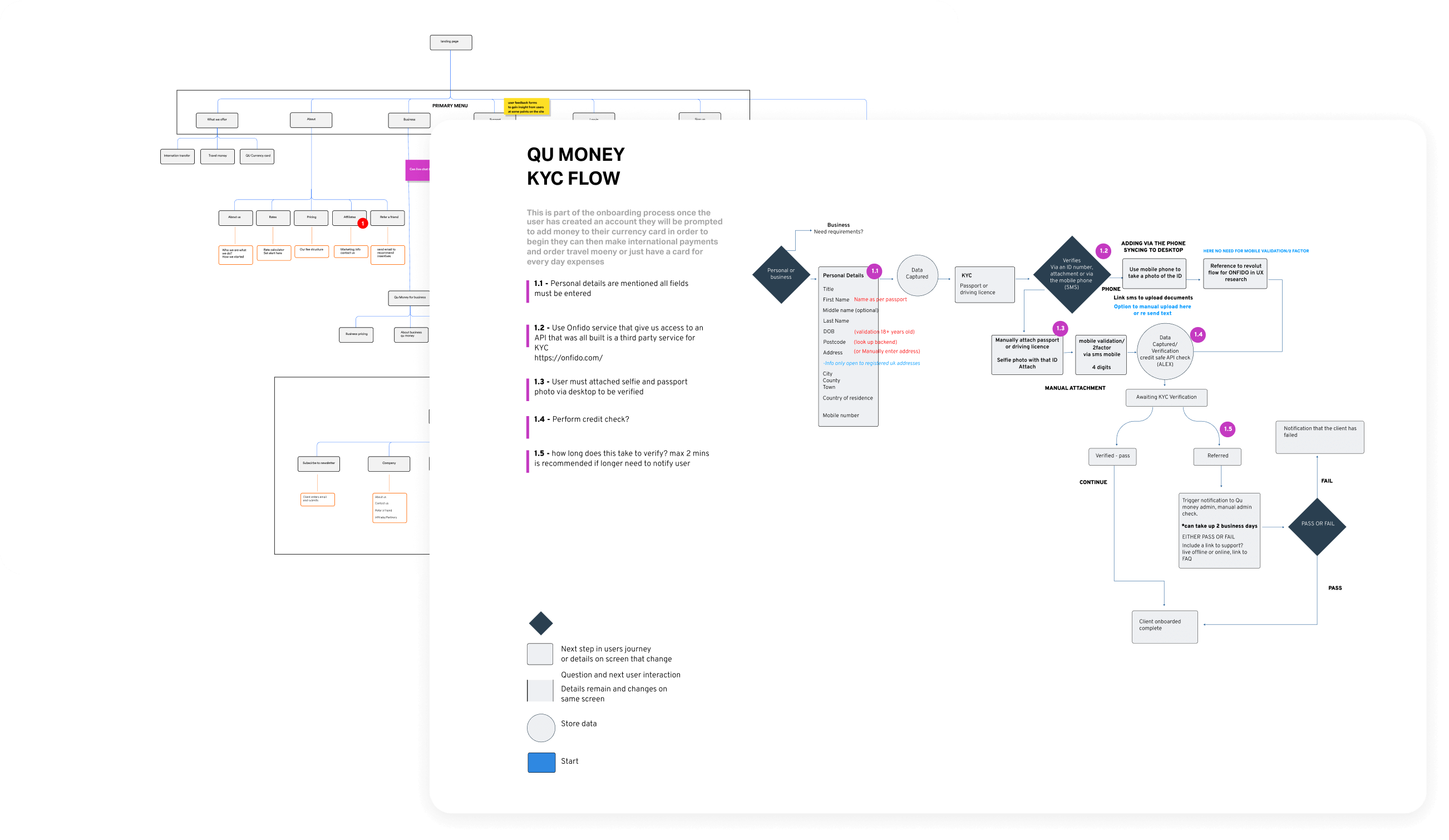

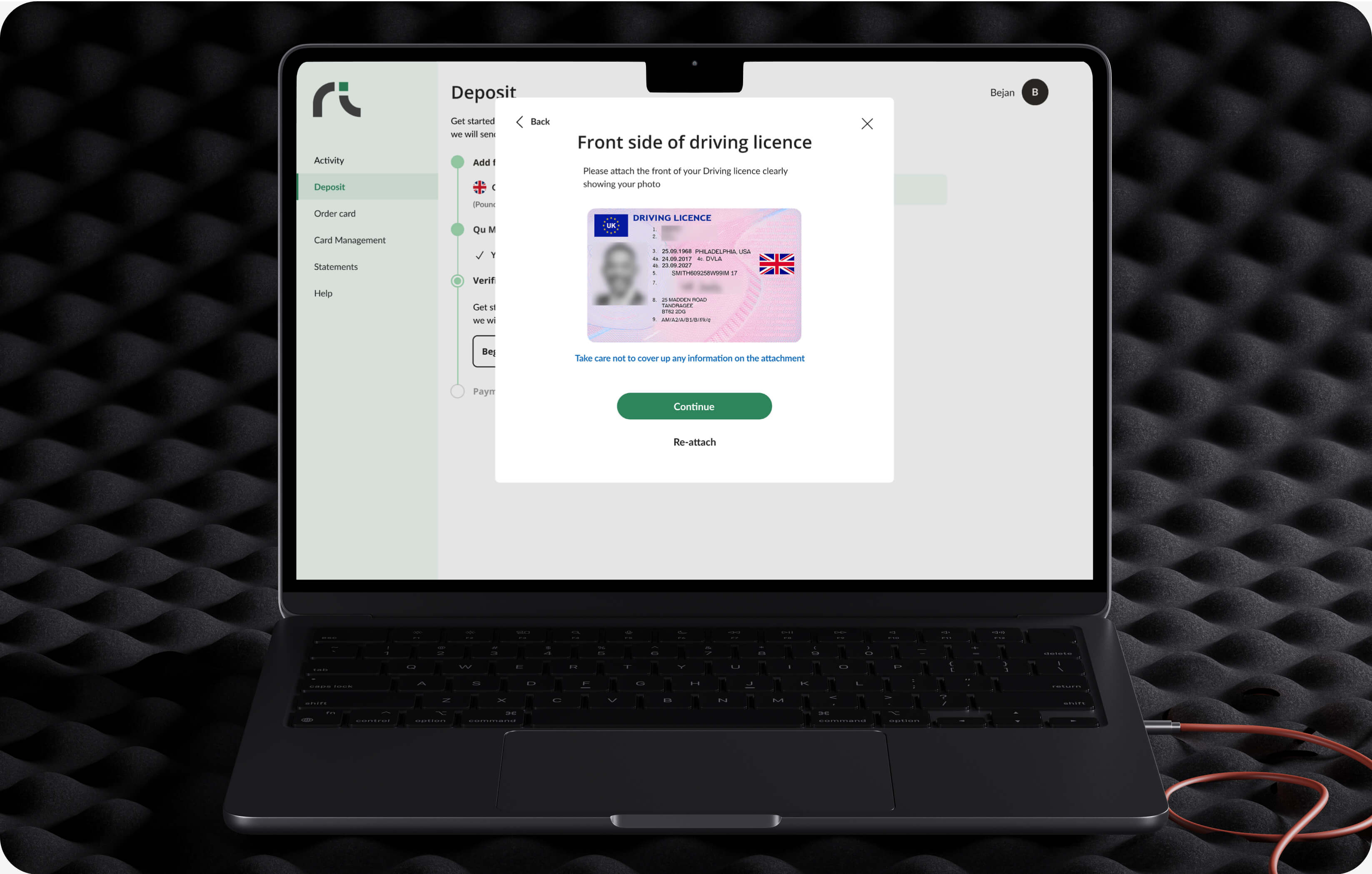

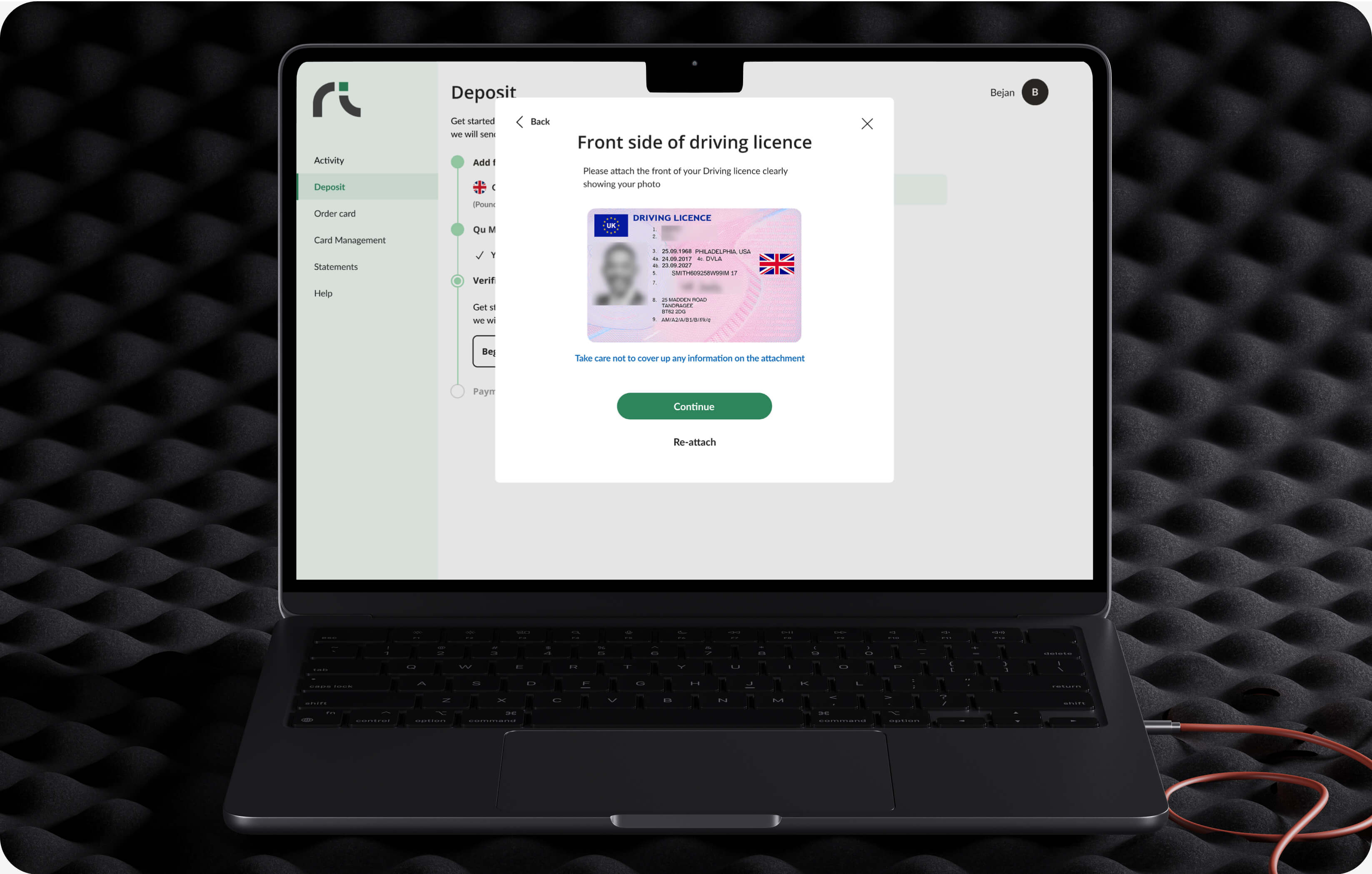

Created many different screenflows to showcase interactions the user will do. Verfication flows/KYC/AML Onboarding are some examples.

Features UI Overview

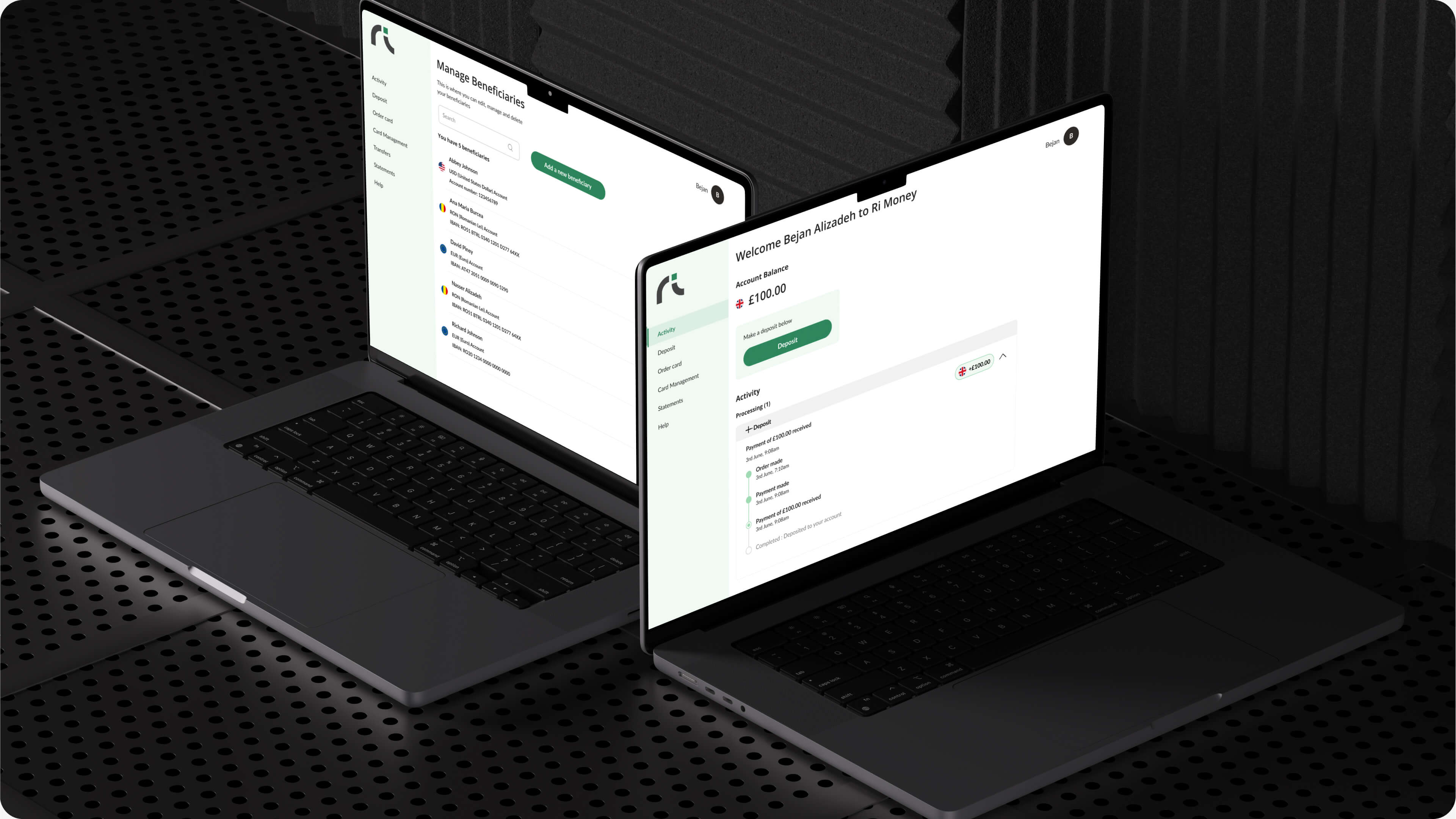

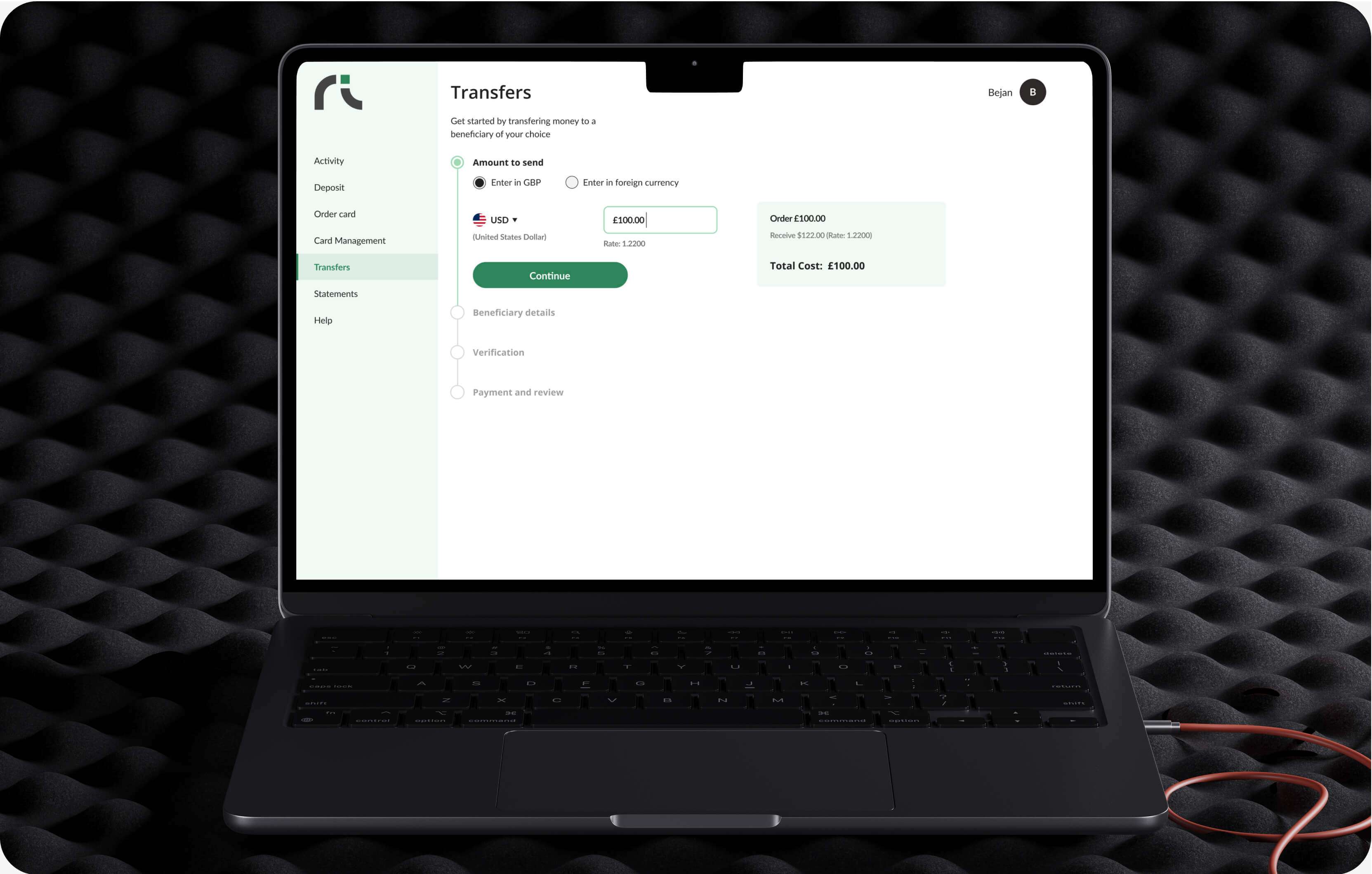

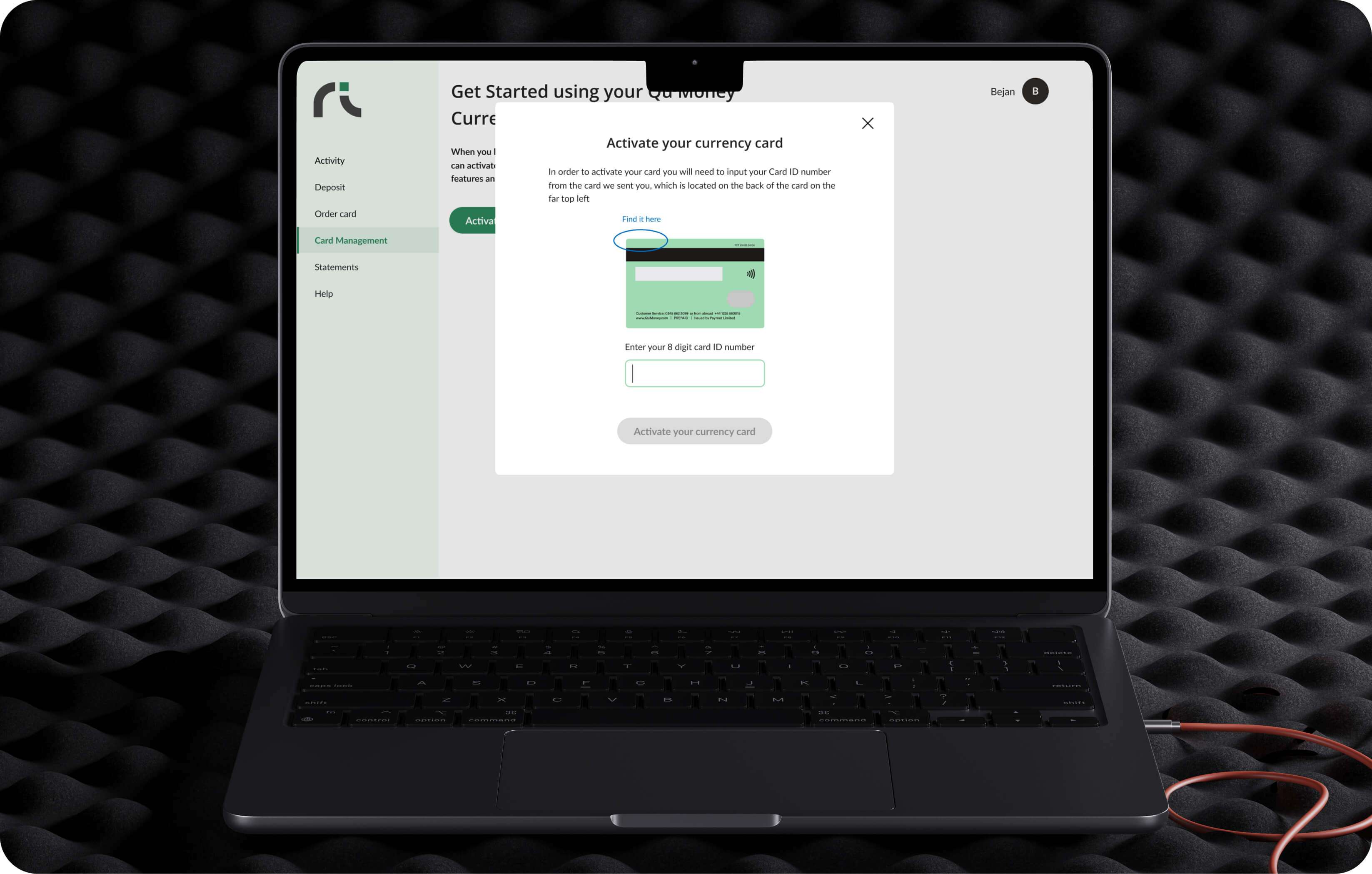

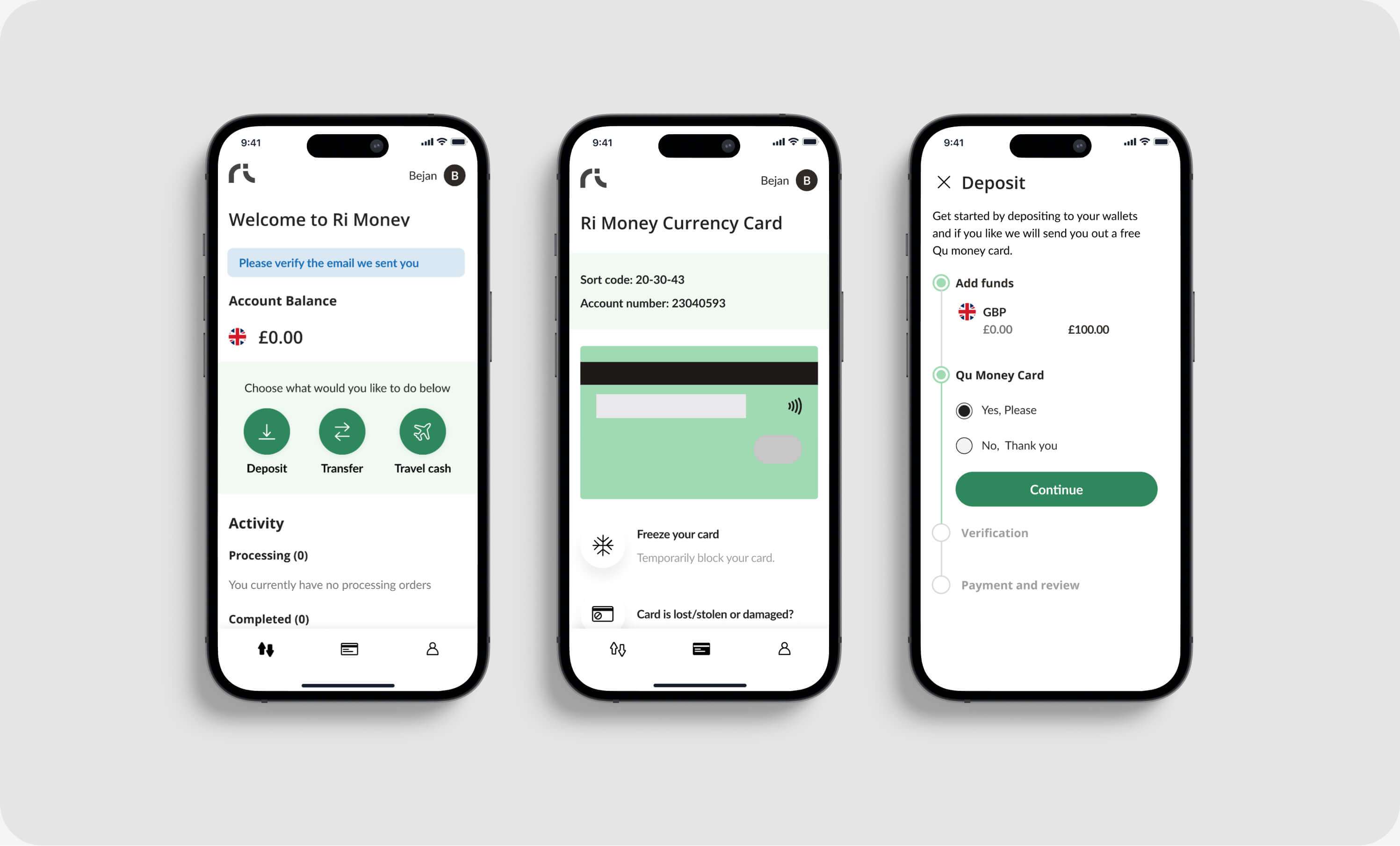

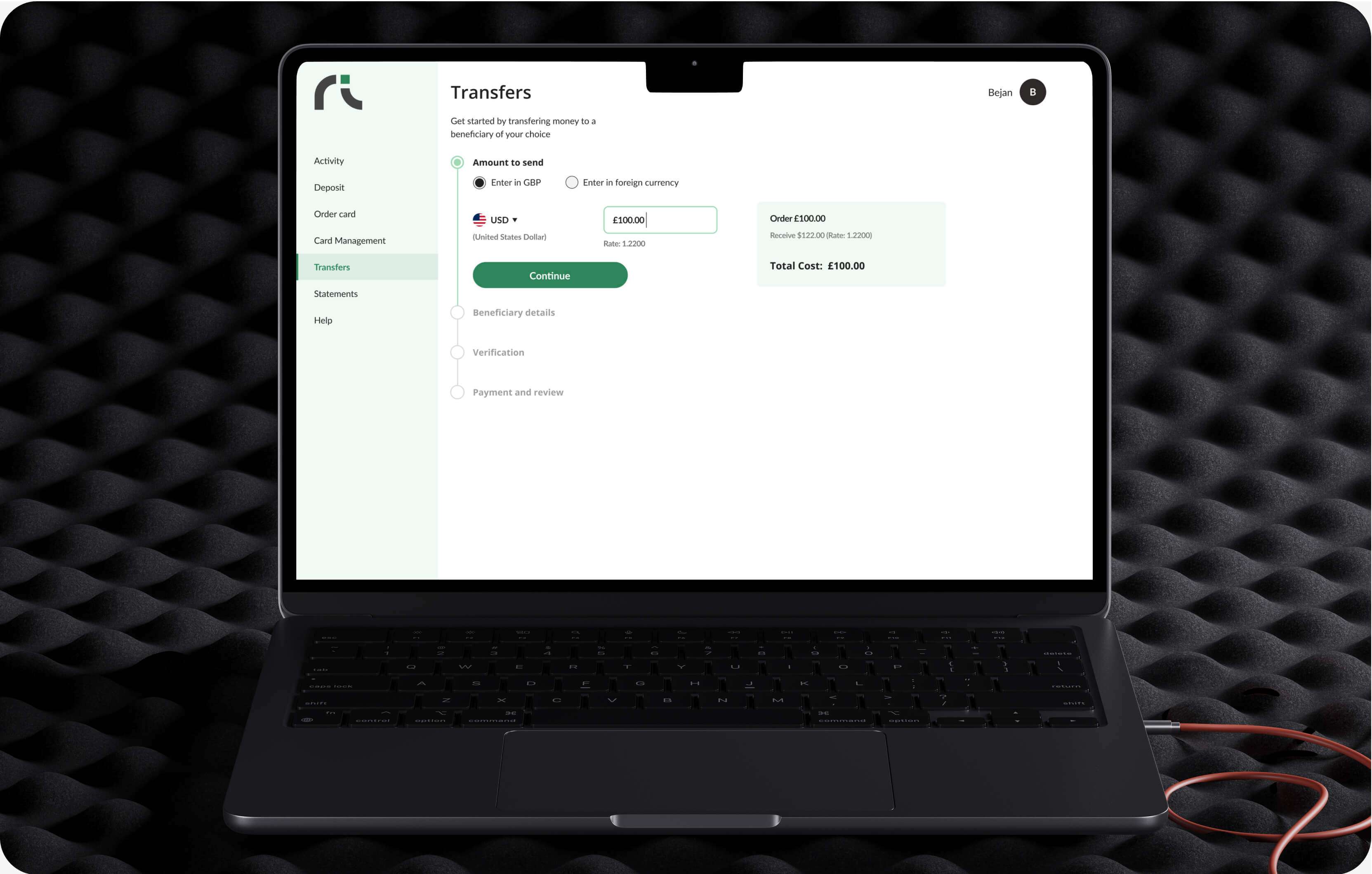

Some of the key features built were a custom KYC/AML system, ability to order travel cash to your home, make international bank transfers, manage your debit card online, download your bank statements and see transactions spent on your debit card. Alot of highlighted features you can see below

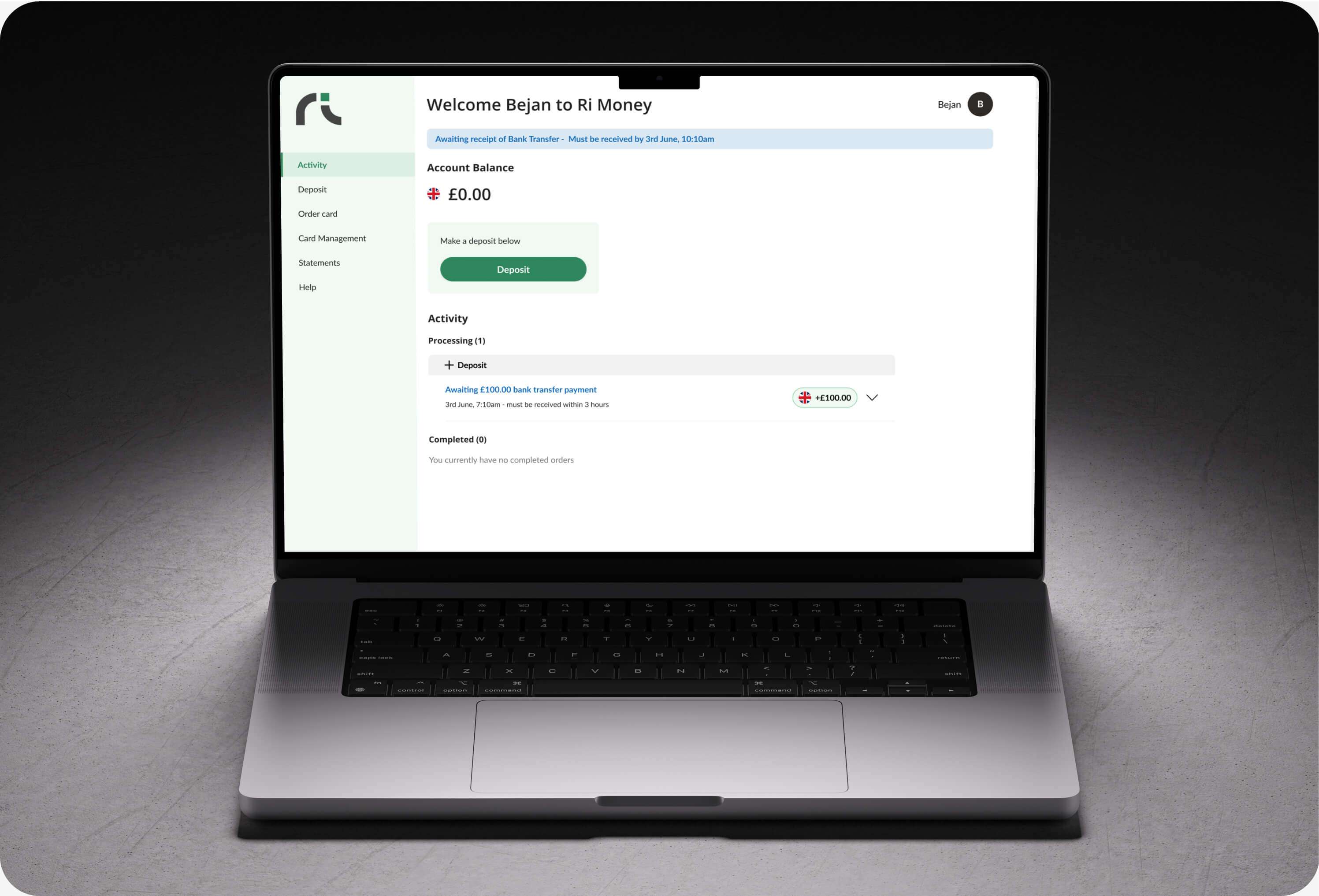

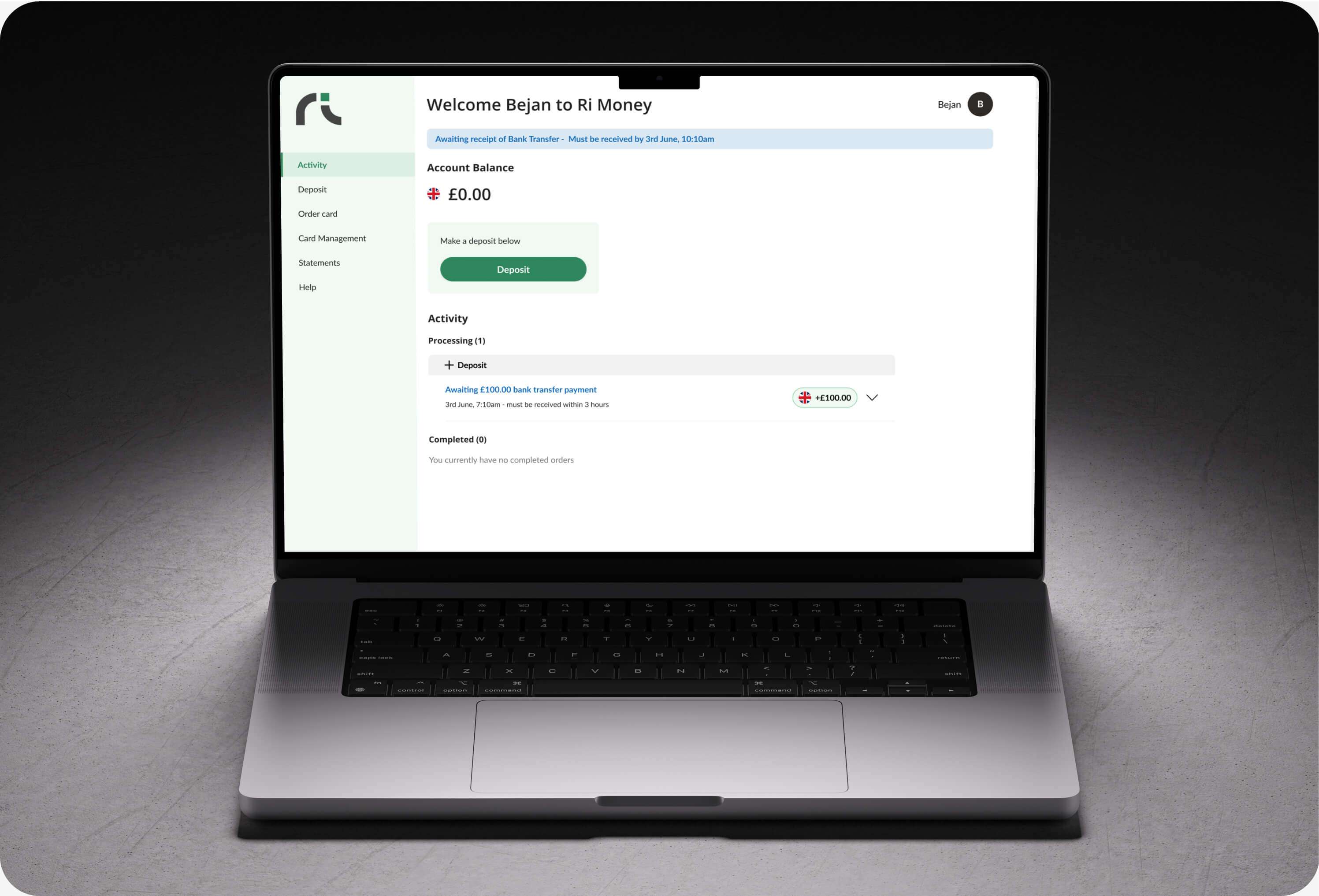

Core Dashboard

Mobile Web Layer Hybrid

Currency Debit Card

International Cash and Transfers

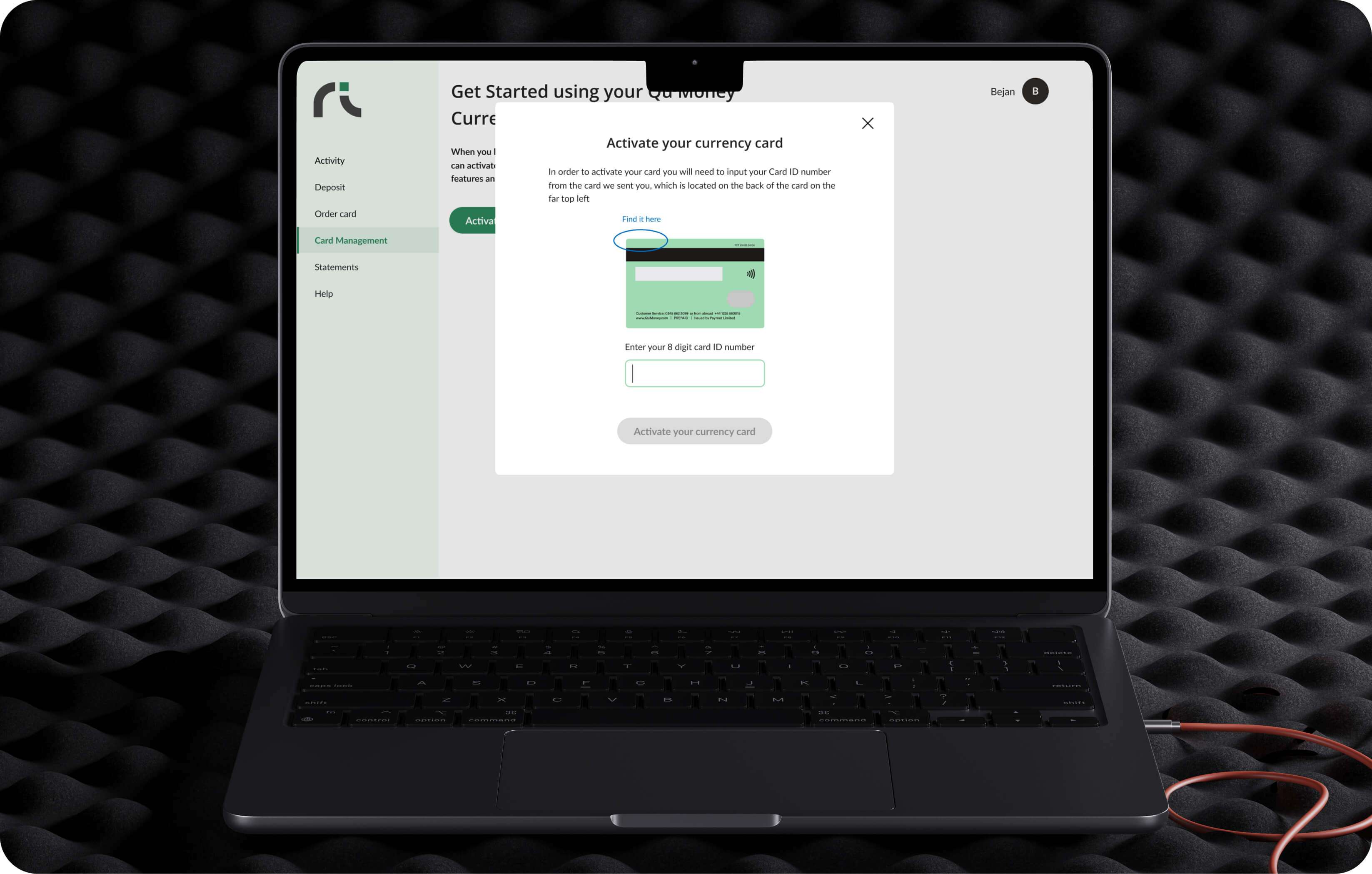

Manage Card Digitally

Building Out Full KYC/AML Engine

Results and Impact

Due to NDA can't disclose the actual name of the brand and results/impact.

Key Learnings

Involve all stake holders and third parties early on, get the development teams involved as soon as flows/process flows have been determined. Keep the product with minimal features intially then gradually release more in stages. Keep a close eye on analytics and website recordings regularly to stay in the loop with small wins that could enhance usability within the interface.

GOAL

The goal was to make travel and the financial association with it more convenient for users with swift international payments with low fees. Aswell as allow users to spend abroad with the best exchange rates with security as a top priority

PROBLEM

With traditional banking there is frustrations with the speed of transactions, the fees involved, regulatory hurdles, poor support/customer service and needing a intuitive user friendly interface

Research

Customer Interviews Persona

Market Analysis Quantitative Surveys

User Journeys Competitive Analysis

PROCESS

Following the Double Diamond design framework that was popularized by the British Design Council. It represents a structured approach to solving design problems and creating user-centered solutions.

UNDERSTANDING THE RESEARCH

Presenting to stake holders decks with research data to accomodate and communicate the users needs and goals. Research synthesized data also takes into account competitor bench marking as well as online reports

FORMING PERSONA’S AND MAPPING THE USER JOURNEY

Planned to better understand the target audience and create more user-centered solutions. The data taken into account was both Quantitative Data and Qualitative Data. This was important to Identify patterns and trends within the space

FURTHER EXPANSION OF USER JOURNEY - TASK FLOWS

I created this document to further support the user journey and visualise the key actions at a highlevel

Synthesis and Key Focus

Translated raw data into actionable insights, facilitating the creation of user-centered solutions that effectively address user goals and challenges.

Mapping It Out

Organized and structured information to enhance user understanding and navigation within the platform. The flows provided a blueprint for how information is organized and how users interact with a product, ensuring a logical and user-friendly experience.

Visual UI Brand - Explore & Play

CREATING UI FOUNDATIONS STYLE GUIDE

Establishing a comprehensive set of design principles, components, and guidelines to ensure consistency and coherence in within the UI. Built using the Atomic system as reference.

WORKING ON THE SCREEN FLOWS

Created many different screenflows to showcase interactions the user will do. Verfication flows/KYC/AML Onboarding are some examples.

Features UI Overview

Some of the key features built were a custom KYC/AML system, ability to order travel cash to your home, make international bank transfers, manage your debit card online, download your bank statements and see transactions spent on your debit card. Alot of highlighted features you can see below

Core Dashboard

Mobile Web Layer Hybrid

Currency Debit Card

International Cash and Transfers

Manage Card Digitally

Manage Card Digitally

Results and Impact

Due to NDA can't disclose the actual name of the brand and results/impact.

Key Learnings

Involve all stake holders and third parties early on, get the development teams involved as soon as flows/process flows have been determined. Keep the product with minimal features intially then gradually release more in stages. Keep a close eye on analytics and website recordings regularly to stay in the loop with small wins that could enhance usability within the interface.

Strive to build successful digital products through evidence — based design

Don’t be a stranger, contact me below anytime. I'm always interested to hear about new projects.

© BEJANPAUL 2022

© BEJANPAUL 2022